Present value of lump sum table

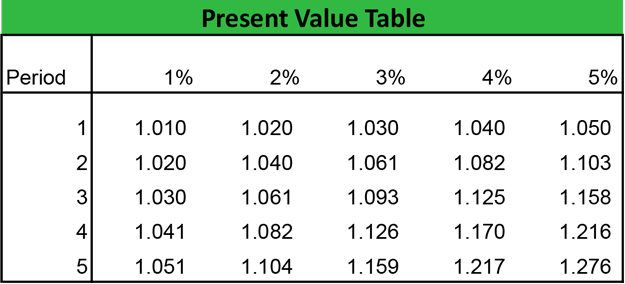

Second mortgages come in two main forms home equity loans and home equity lines of credit. In the example above the amount of money you need to invest today that will accumulate to 1020 a year in the.

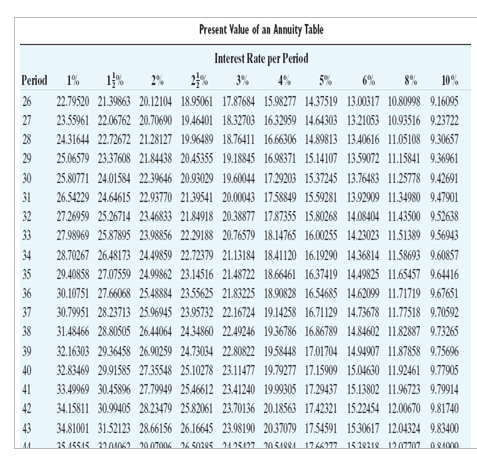

Solved Present Value Of An Annuity Table Period 2 Interest Chegg Com

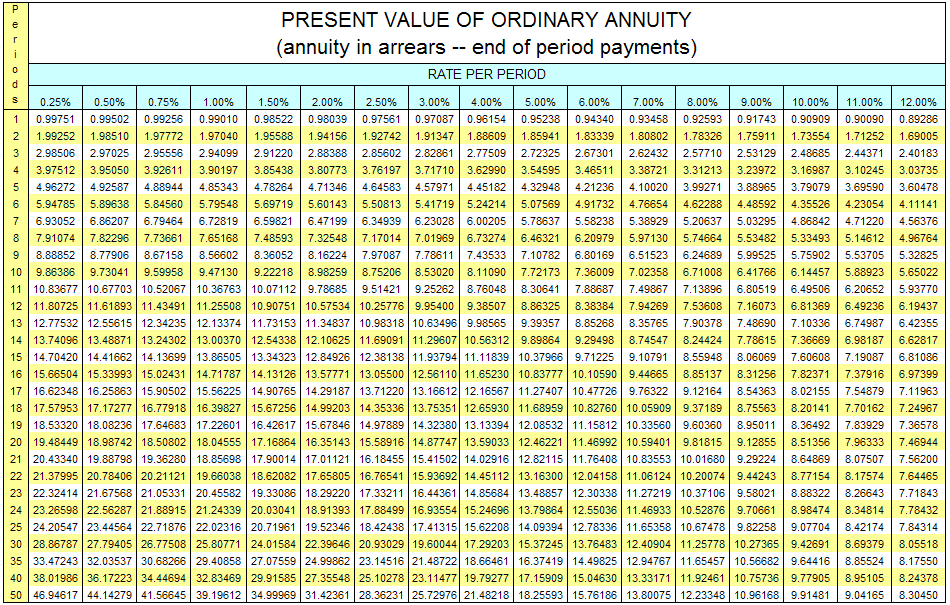

Annuities are either lump-sum payments or multiple payments made at regular intervals.

. The option price is the lower of the stock price at the time the option is granted or at the time the option is exercised. A home equity loan commonly referred to as a lump sum is granted for the full amount at the time of loan origination. Generally for plan years beginning after December 31 2007 the applicable interest rates under Section 417e3D of the Code are segment rates computed without regard to a 24 month average.

Here we also discuss the Present Value vs. Pine Company deducts 5 from Adrians pay every week for 48 weeks total 240 5 48. New income code 56 was added to address section 871m transactions resulting from combining transactions under Regulations section 1871-15n including as modified by transition relief under Notice 2020-2.

Enter the dollar amount as the future lump sum. The time value of money is among the factors considered when weighing the opportunity costs of spending rather than saving or investing. The sales price is separately discounted to its present value of 548471.

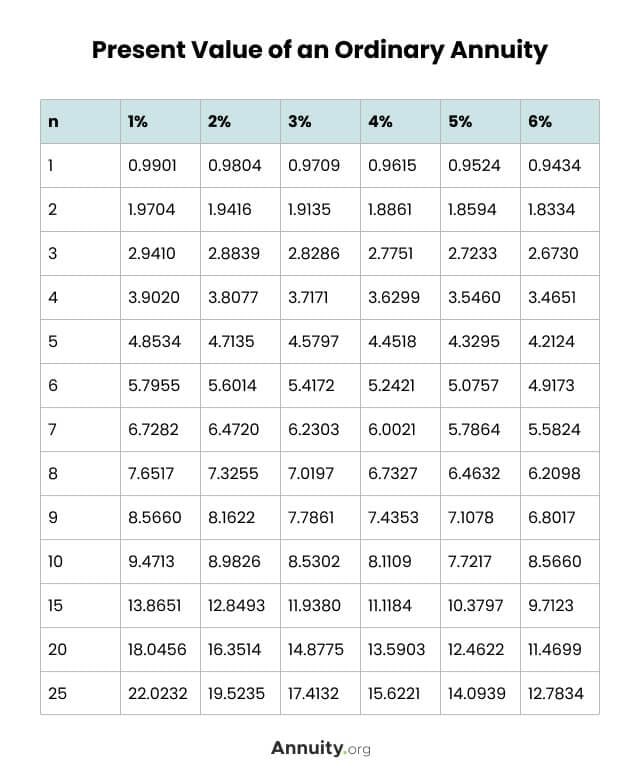

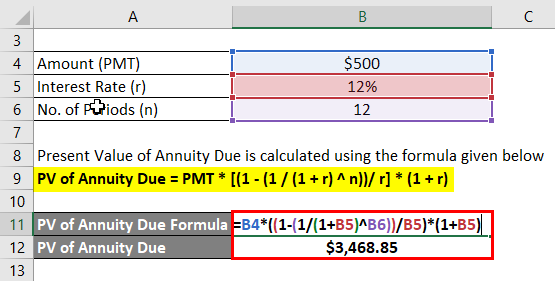

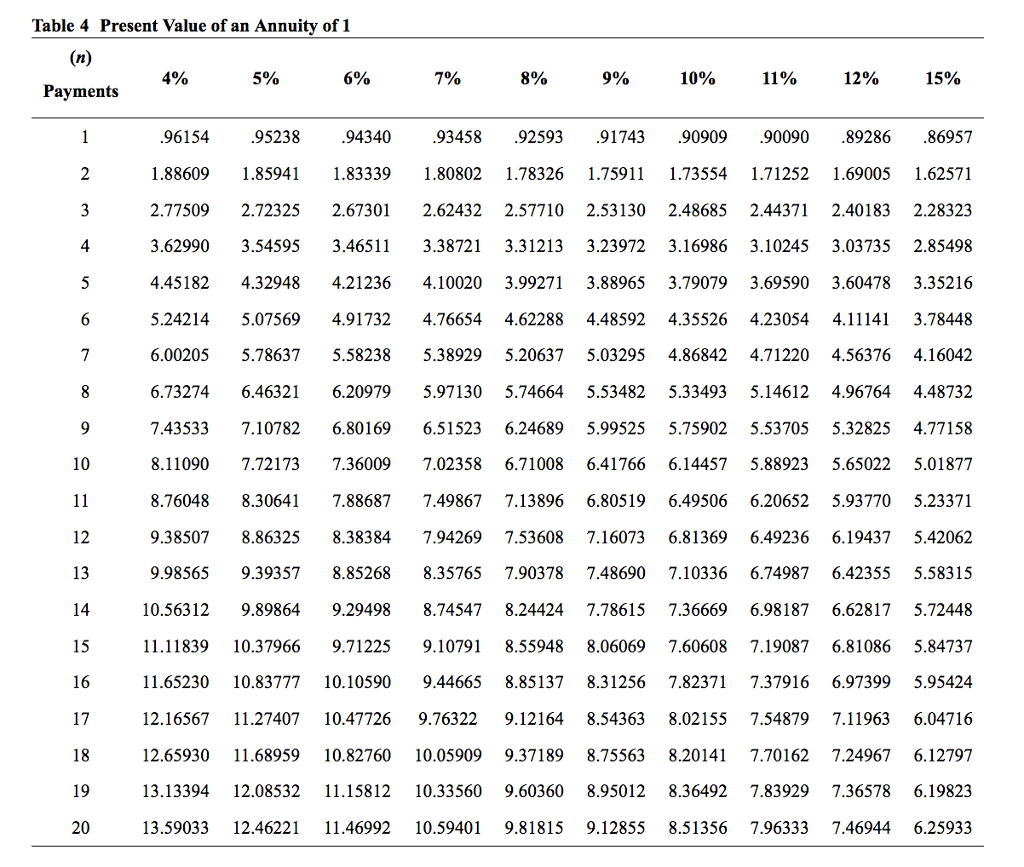

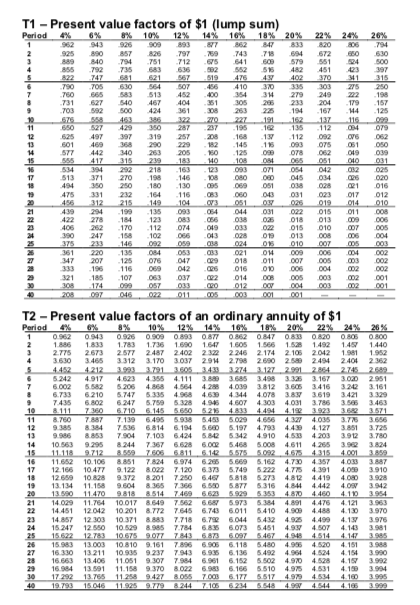

In short present value vs future value is a lump-sum payment and a series of equal payment over equal periods of time is called as an annuity. The present value of an annuity table is a table which shows calculations of the present value of an annuity factor. Sinking fund is a fund which is created out of fixed payments each period annuities to accumulate to a future some after a specified period.

Using the Present Value Calculator. Present Value - PV. We will guide you on how to place your essay help proofreading and editing your draft fixing the grammar spelling or formatting of your paper easily and cheaply.

Present Value Of An Annuity. ASCII characters only characters found on a standard US keyboard. For example it can help you determine which is more profitable - to take a lump sum right now or receive an annuity over a number of years.

Present Value Discount Rate. The present value of an annuity is the current value of a set of cash flows in the future given a specified rate of return or discount rate. This has been a guide to the top difference between Present Value vs Future Value.

Must contain at least 4 different symbols. Present Value vs Future Value Comparison Table. PBGCs benefit payment regulation CFR Part 4022 provides that when PBGC trustees a plan if the value of a participants benefit is less than 5000 PBGC will generally pay that amount in one lump sum in lieu of a monthly annuity.

Prior to 2021 PBGC used an immediate and deferred interest rate structure for this purpose. The time value of money is the widely accepted conjecture that there is greater benefit to receiving a sum of money now rather than an identical sum later. When talking about a single cash flow ie.

That value is discounted back to the beginning of Year 1 value 259357 by treating it as a lump sum. Changes to Form 1042-S. The Research Analysis team delivers growth to the business in a variety of ways.

Use the interest rate at which the present amount will grow. Using present value of an annuity table it is possible to calculate how much the lump sum of the annual payments would be currently. Present value is the sum of money that must be invested in order to achieve a specific future goal.

Second mortgage types Lump sum. Future value is the dollar amount that will accrue over time when that sum is invested. The table helps an investor in making informed decisions while planning for investments.

The present value factor declines with higher interest rate other things remaining the same. Due to the complexity of the calculation people use the table. Present value PV is the current worth of a future sum of money or stream of cash flows given a specified rate of return.

Future cash flows are discounted at the discount. This table provides the monthly segment rates for purposes of determining minimum present values under section 417e3D of the Internal Revenue Code. The following income chapter 3 status and Limitation on benefits LOB codes were added to Form 1042-S.

10-year periodic payments with no life annuity payments after. Interest rates on such loans are fixed for the entire loan term both of which are determined when the second mortgage is initially. The value of the stock when the option is exercised is 20.

It may be seen as an implication of the later-developed concept of time preference. The plan must use reasonable assumptions or factors but does not have to use 417e applicable interest and mortality rates to determine the present value of accrued benefits for any other distributions subject to IRC 417e that are calculated on a lump sum-based formula such as. The present value of the rents and sales price are combined to produce the.

I the one-year prohibition on seeking or accepting employment or any form of compensation or financial benefit from any contractor or vendor with whom a former staff member has had personal. A pension plan is a retirement plan that requires an employer to make contributions into a pool of funds set aside for a workers future benefit. 6 to 30 characters long.

Future Amount The amount youll either receive or would like to have at the end of the period Interest Rate Per Year Discount Rate The annual percentage rate investment return youd earn over the period of your investment Number of Years The total number of years until the future sum is received or the total number of years until. Get 247 customer support help when you place a homework help service order with us. The pool of funds is invested on the.

The value of the stock when the option was granted was 25. Think of the present value of a lump sum in the future as the money you would need to invest today at a rate of interest that would accumulate to the desired amount in the future. The future cash flows of.

As you can see DCA underperformed LS by 4 or more on average over 24 months in every single asset class tested and across the vast majority of starting months. The following table lists currently available rates for savings accounts money market accounts and CDs. In everyday life the present value comes in useful too.

Note When the interest rate rises the present value of a lump sum or an annuity declines. Market Research helps find new markets and opportunities across Australia and beyond Voice of the Customer VoC is our vital link to our customers their voices and what they think about our business products and services Better By Standards delivers. ERISA 4022 Lump Sum Interest Rates.

Types of Present Value Present Value of a Lump Sum. Research and Analysis. Rather than bury you in chart after chart showing Lump Sums superior return performance over DCA across a range of different asset classes I created this summary table.

One payment period the present value formula is as simple as this. It calculates the present value and future value of the annuity considering the value and the time period of the investment.

Present Value Of A Lump Sum Formula Double Entry Bookkeeping

Appendix 5 Present Value Factor Of A Lump Sum Pvf Of Re 1 Financial Accounting For Management An Analytical Perspective 4th Edition Book

Time Value Of Money Board Of Equalization

Future Value Factors Accountingcoach

What Is An Annuity Table And How Do You Use One

Present Value Formula Calculator Annuity Table Example

Lottery Winner S Dilemma Lump Sum Or Annuity

Time Value Of Money Board Of Equalization

Solved The Table Shows The Lump Sum Amount Of Money Chegg Com

Annuity Present Value Pv Formula And Excel Calculator

Present Value Of Annuity Due Formula Calculator With Excel Template

Solved Exercise 11a 3 Basic Present Value Concepts L011 5 Chegg Com

Present Value Tables Double Entry Bookkeeping

Compound Interest And Present Value Ppt Video Online Download

Solved Question 6 Click Here To View The Factor Table Click Chegg Com

Solved Answer The Following Problems On Your Own Paper Chegg Com

Present Value Of A Single Amount Quiz And Test Accountingcoach